When it comes to choosing the right payment gateway for your online – especially international – business, the decision often narrows down to two giants: PayPal and Stripe. Both platforms have transformed the way businesses handle payments, offering robust features, global reach, and streamlined user experiences. If you’re wondering “Paypal vs. Stripe – which is better?”, this detailed comparison will help you understand the differences, especially in terms of local and international fees, convenience of use, and e-wallet support.

As someone deeply involved with payment integrations, I can share insights from personal experience. Super Teacher currently integrates Stripe and is preparing to launch PayPal integration soon, aiming to provide users with even more flexibility. Let’s dive into what sets these two platforms apart and which might be the best fit for your business.

Local and International Fees: A Closer Look

One of the most critical considerations when choosing between Stripe and PayPal is the fee structure. Fees can impact your margins, especially if you handle a high volume of transactions or international sales.

Stripe Fees

Stripe’s fee structure is transparent and straightforward. For domestic transactions, Stripe typically charges around 2.9% + 30 cents per successful transaction and about 3.9-4.5% _ 30 cents per international transaction. Additionally, if currency conversion is involved, Stripe charges another 1% fee on top of that. This rate is competitive with industry standards. Stripe’s fees also apply to various payment methods, including credit and debit cards, and digital wallets.

PayPal Fees

PayPal’s fee structure is slightly more complex and varies depending on the type of account and transaction. For domestic transactions, PayPal charges roughly 2.9% + 30 cents per transaction, similar to Stripe.

However, international transactions can be more expensive. PayPal charges an additional 4.4% on top of the base rate, plus a fixed fee based on the currency received. This can make cross-border payments notably pricier compared to Stripe.

Currency conversion fees with PayPal can also be higher, with rates sometimes exceeding 3%, depending on the currency pair.

Which Is More Cost-Effective?

For businesses with mostly local customers, both Stripe and PayPal offer competitive rates that are quite similar. However, if you have a significant volume of international transactions, Stripe’s fees tend to be more economical overall.

That said, the best choice depends on your specific sales geography and volume. It’s worth running your own numbers based on expected transaction amounts and currencies.

Convenience of Use: User Experience and Integration

Beyond fees, convenience plays a huge role in deciding between Stripe and PayPal. How easy is it to set up, customize, and manage payments on each platform?

Stripe’s Developer-Centric Approach

Stripe is renowned for its developer-friendly APIs and extensive documentation. This makes it a favourite among businesses that want deep control over the payment experience. With Stripe, you can:

- Customize checkout flows to match your brand

- Integrate advanced features like subscription billing and fraud prevention

- Access detailed reporting and analytics

However, because it is more technical, businesses may need developer resources to fully leverage Stripe’s capabilities. For companies like Super Teacher, Stripe’s flexibility has been invaluable for integrating payments seamlessly into the platform.

PayPal’s Plug-and-Play Simplicity

PayPal excels in ease of use for both merchants and customers. Setting up a PayPal business account is quick, and many platforms support PayPal integration out-of-the-box.

Customers appreciate PayPal because of its familiarity and trust factor. Many users already have PayPal accounts, making checkout fast and secure without entering card details directly.

While PayPal also offers APIs for customization, its feature set is generally less flexible than Stripe’s, focusing more on straightforward payment acceptance.

Which Platform Offers Better Convenience?

If you want a simple, quick-to-deploy option with strong brand recognition, PayPal is an excellent choice. On the other hand, if you prioritise control, customization, and advanced payment features, Stripe is more suitable.

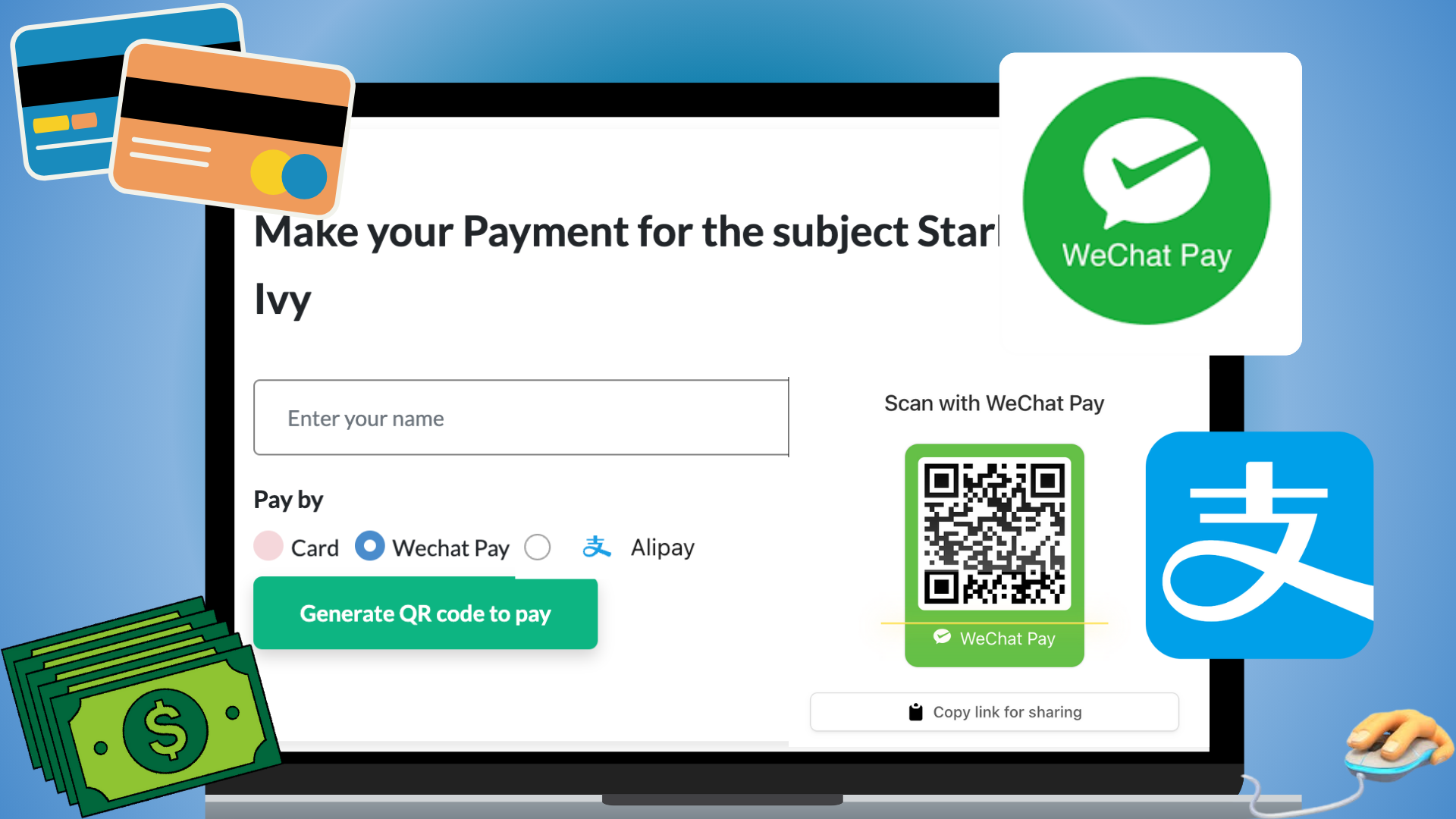

Supported E-Wallets and Payment Methods

Supporting multiple payment methods, including e-wallets, can boost conversion rates by giving customers their preferred checkout options. Here’s how Stripe and PayPal compare:

Stripe’s E-Wallet Support

Stripe supports a wide range of e-wallets and alternative payment methods, including:

- Apple Pay

- Google Pay

- Microsoft Pay

- Alipay

- WeChat Pay

- ACH Direct Debit

This comprehensive support is part of Stripe’s global strategy to cater to diverse markets and user preferences.

PayPal’s E-Wallet Ecosystem

PayPal itself is an e-wallet and also supports:

- Venmo (in the US)

- PayPal Credit

- PayPal Pay in 4 (installment payments)

- Debit and credit cards

PayPal’s e-wallet ecosystem is highly trusted and widely used, especially in North America and Europe.

Choosing Based on E-Wallet Support

If your audience prefers mobile wallets like Apple Pay or Google Pay, Stripe’s broad support might be more appealing. Conversely, if your customers are accustomed to PayPal and its related services, integrating PayPal could enhance trust and ease of payment.

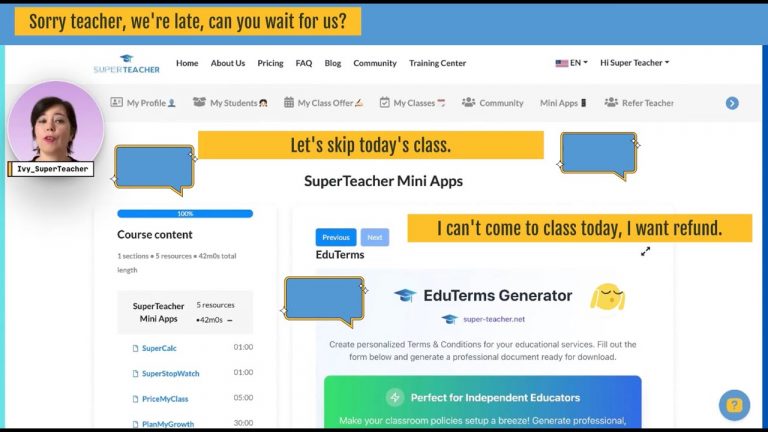

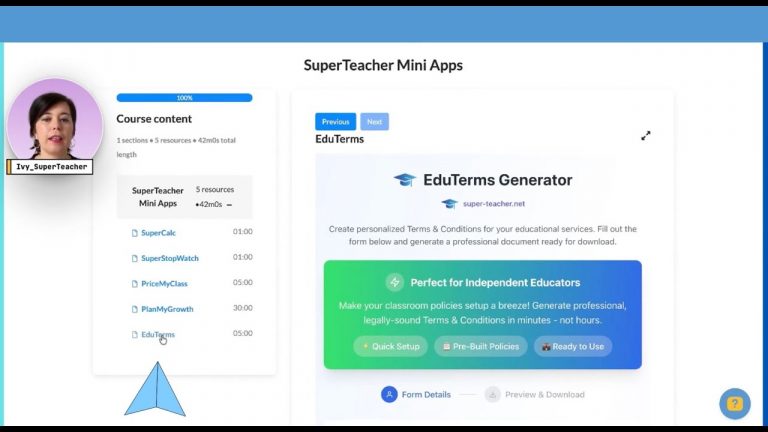

Super Teacher’s Payment Integration Journey

To illustrate these points, let me share a bit about Super Teacher’s experience. Currently, SuperTeacher utilizes Stripe as its primary payment processor. This has allowed for a smooth, flexible payment system tailored to our unique needs.

Looking ahead, SuperTeacher is preparing to launch PayPal integration soon. This move aims to provide users with additional payment options, recognizing that different customers have different preferences. By supporting both Stripe and PayPal, SuperTeacher can cater to a broader audience and enhance the overall payment experience.

Conclusion: Paypal vs. Stripe – Which Is Better?

Deciding between PayPal and Stripe ultimately depends on your business priorities, customer base, and technical capabilities. Here’s a quick summary to help you decide:

- Fees: Stripe tends to be more cost-effective for international transactions, while both are comparable for local payments.

- Convenience: PayPal offers quick setup and widespread recognition; Stripe excels in customization and developer tools.

- E-Wallet Support: Stripe supports a wider variety of e-wallets, while PayPal shines in its own trusted ecosystem.

- Integration: Businesses like SuperTeacher benefit from Stripe’s flexibility but are adding PayPal to meet diverse customer needs.

For many businesses, the ideal solution might be to integrate both payment gateways, offering customers the choice and maximizing conversion rates. If you’re still asking “Paypal vs. Stripe – which is better?”, consider your specific use cases and customer preferences carefully.

By understanding the nuances of fees, convenience, and payment methods, you can make an informed decision that supports your business growth and provides a seamless checkout experience.

Looking for an all-inclusive preset system where you can just sign up, get set and start selling worldwide in minutes? Look no further, we got you covered! ⬇️